Wockhardt is my pick in Pharma-Biotechnology space

Wockhardt Ltd (WOCKPHARM.NS) - an India Pharma-Biotech company is my share pick. The company has shown considerable growth in the last two years, and given the last quarterly results, the company is poised for a growth rate of over 20% for the financial year 2006.

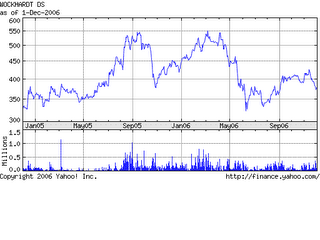

Given the current share prices at ~ Rs 380, it is an attractive buy for long term investments. The current problems associated with Wosulin will be a temporary one. See chart.

Company has a global mindset with a well distributed revenue stream - from Europe, US & India. R&D centric approach to market, having a highly talented & culturally diverse workforce will help the company in good stead in the future. The company spends substantial amont on R&D - approx Rs 1.04 Billion or 7.4% of revenue. While this does not compare favorably with global pharma gaints, but this a lot better when compared to other Indian pharma companies - Cipla spends about 5% of its revenue on R&D.

The company has a highly talented workforce with about 400+ scientists including 100+ Ph.Ds. This allows company to focus on biotech research and develop new products focused on Diabetes, hepatitis-B, and Cancer. The results of this focus can be seen in the number of patents filed (215+) by the company.

Summary

The current share price of Rs 380 is an attractive buy for a long term investments. The expected return on this investment will be around 20-25% over the next year.

0 Comments:

Post a Comment

<< Home