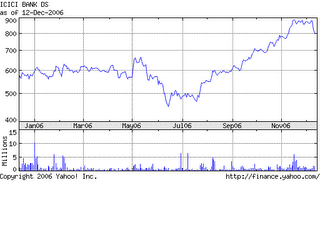

Managing a Stock Portfolio

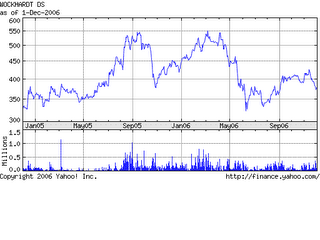

In an earlier post, I had recommended Wockhardt Ltd (WOCKPHARM.NS) - an India Pharma-Biotech company as my share pick at Rs380. While this is definitely a good stock to invest, I got the timing wrong. The market went into a minor correction last Friday - December 8th to December 13th 2006. During this correction, the stock fell to Rs 330.

Since my recommendation is for long term - one can ignore minor corrections and continue to hold or take some reactive steps to lower the cost of acquisition.

The first step to do when buying a stock is to place a stop order if the stock falls by 1-2% from the acquisition price. In this case, have a stop order at Rs 375. After the sell order is executed, watch the stock and the market index and the sector stocks carefully. Once if the stock price stops falling and starts to raise - jump into a buy immediately ( buy with another stop order in place).

This Buy-sell-buy routine will lower the cost of acquisition of the shares - even when including the transaction cost of Rs 20 per trade. In this case lets see the Buy-sell-Buy routine and valuate the effective cost of acquisition. (decimal values are ignored for simplicity of calculations)

Buy 10 shares at Rs. 380 = Rs. 3820 cash outflow (Rs. 20 is transaction fee)

Sell 10 shares at Rs. 375 = Rs. 3730 cash inflow (Rs. 20 is transaction fee) - A loss of Rs 90.

Buy 10 shares at Rs. 330 = Rs. 3320 cash outflow.

This results in a net acquisition price of Rs 341. Vs an earlier acquisition price of Rs 380.20!

Another very important piece of Advise: Never invest in a stock - based solely on someone’s recommendations. Do your research. Read the company’s financial reports for last 3 years, news reports, and do some financial analysis before investing in any stocks.